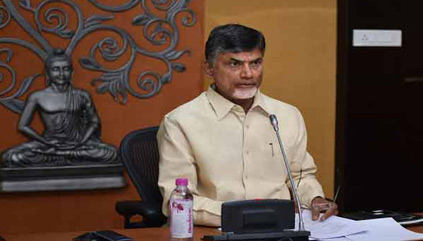

CM reviews Finance and Revenue receipts for the first quarter

CM orders Rs.660 crore towards DWARCA women

Rs.955.41 crore will be released towards industrial incentives and subsidies

On Thursday, the Chief Minister reviewed the reports of revenue collection, targets and expenditure for the first quarter of this fiscal year, with Finance Minister Yanamala Ramakrishna, financial secretaries Ravichandra and K. Sunita and Special Chief Secretary to the CM, Satish Chandra.

The Commercial Taxes department alone has witnessed a growth of 11.27% in the first quarter. While they earned Rs. 8,130 crore in the first quarter last year, the department received revenue worth Rs.9,056 crore.

The Prohibition & Excise department and the Mines & Geology department witnessed better growths of 49.93% and 68% respectively. The Transport department earned revenue worth Rs.833.02 crore, which is 30.21% more than the last year.

Both the Registration & Stamps and the Land Revenue departments saw significant dips of 11.28% and 19.22% respectively. The Forest department saw no significant change from 2016-17 in the revenue collected in the first quarter.

The officials reported to the Chief Minister that there is a net growth of 15.92% from the first quarter of 2016-17 and that the roll out of the Goods & Services Tax has led to uncertainty about achieving the set targets for this fiscal year.

The total receipts of revenue during the first quarter of 2017-18 amount to Rs.32,978 crore and the total expenditure is Rs.35,463 crore.

The sector with the most expenditure of revenue during the first quarter this year is Water Resources, spending almost double money as the first quarter of 2016-17. Secondary Education comes second, and Panchayat Raj & Rural Development comes third.

Goods & Services Act

The Goods and Services Act was also discussed at length, during which the implications on the common man, the businessman and trading communities was deliberated. The Chief Minister was informed that legal and administrative frameworks are in place for successful implementation of the act.

In the case of small businesses, dealers with annual turnover upto Rs.20 lakh are exempt, and between Rs.20 lakh and Rs.75 lakh can opt for composition without input tax credit.

Food grains (wheat, rice etc.), pulses, vegetables, eggs, fish, meat, milk, atta, maida, jaggery, bread, butter, salt are exempt from tax. Tea, coffee, sugar, dry chillies, LPG gas, turmeric powder, milk powder, rusks, oil seeds, vegetable oils, essential drugs and insulin are taxable at 5% only.

Debt Swapping

The Finance Department also reported that negotiations with 7 banks have led to lowered interest rates ranging from 10.2 or 12.05 down only 8.4 or 9%.

APSRTC saved Rs.46.11 crore per annum through debt swapping and AP Civil Supplies Corporation also negotiated for low interests. The Finance Department has written to other corporations to asking them to submit the details of their high cost loans and is awaiting their responses.

“Debt swapping is sure to promise better results and we should encourage it,” said the Chief Minister.

Commitments due

In light of the commitments made during the padh-yatra before his election, the Chief Minister gave the order to release Rs.6,600 crore towards DWACRA self-help groups (Vaddileni Runalu) and Rs.955.41 crore towards industrial incentives and subsidies.

Way forward

They also reported that new plans for Debt Management and Expenditure Management are in action, and will be ready with the final review by the end of August after extensive research, data collection, preliminary analysis, development and testing.

The State Government is also preparing to change the fiscal year from April-March to January-December to fall in line with the GoI. The Presentation of Budget 2018 to the Legislature will take place in the last week of November 2017. Thus April-December 2017 will be considered the “transitional financial year”.